St. Mary Can Receive Up to $1,500 per Household with No Extra Money Out of Your Pocket.

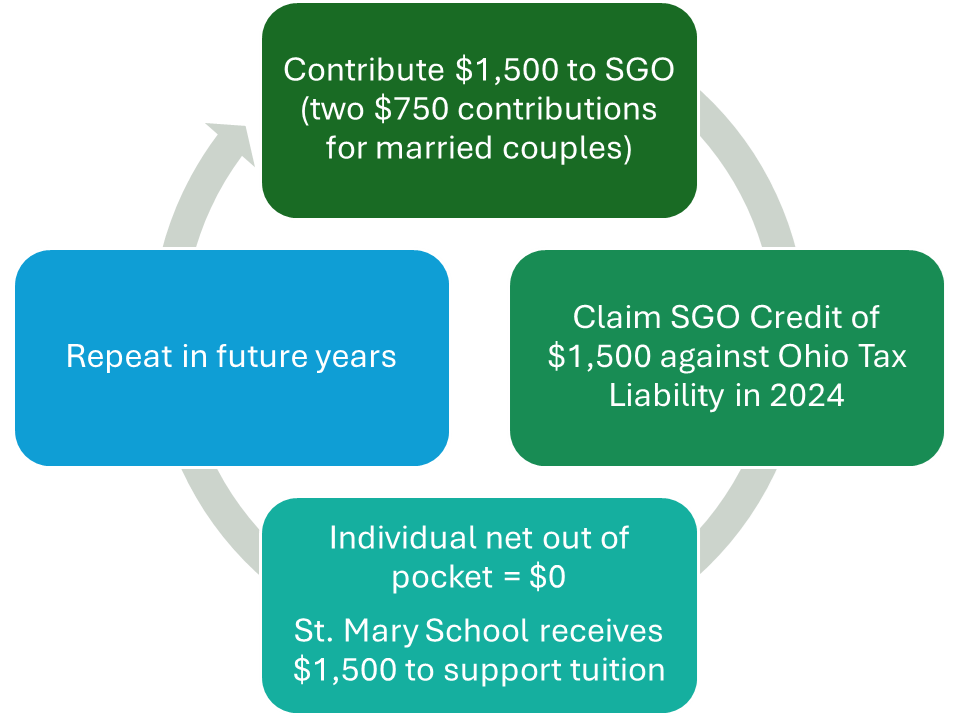

We have exciting news to share with our St. Mary Family and supporters. The Archdiocese of Cincinnati is an approved Scholarship Granting Organization (SGO) through the Catholic Education Foundation (CEF) for all schools in the archdiocese. Most families and parishioners with $100,000+ household income will receive a FULL dollar-for-dollar Ohio tax credit for contributions to a qualified SGO. Contributions to an SGO result in No Extra Money Out of Your Pocket, and St. Mary will receive $1,500 (per married couple or $750 individually) to support tuition for our students. We encourage families to consult their tax advisor to confirm that this opportunity is right for your family.

Why Should I Do This?

- Redirect YOUR tax dollars from the government to St. Mary School.

- No cost to you, benefit to St. Mary School

- You can receive CREDIT CARD points when funding the SGO via credit card!

- This applies to ANY resident of Ohio—not just the parents of St. Mary School (yes, you can forward this to friends and family to support!).

How long does this take to complete?

- The donation process will take LESS than 5 minutes to complete

Where do I get started?

Online:

- It’s easy—visit https://catholicbestchoice.org/sgo/ and choose “Give Today.” Select “St. Mary School (Hyde Park)“ from the drop-down menu to designate your donation today.

- Fill in your information and payment details. (If you are a married couple filing jointly, select the “Add Second Donor” box and complete the required fields.)

- Click “Donate” and save your receipt to include with your state tax return. Watch your generosity add up and impact students for years to come!

Or, send a check through the mail – Download this FORM.

2024 SGO Gifts can be made until April 15, 2025, or before you file your tax return, whichever comes first, to claim and include on your 2024 Tax Return.

What is the process to claim the tax credit?

- Share your contribution confirmation with your tax preparer (or online software such as TurboTax will prompt you for any amounts contributed to a qualified SGO).

Frequently Asked Questions

- My spouse and I would like to make a $1,500 contribution to the SGO. Can we write one check or make one contribution online and receive the $1,500 credit? Under the direction of the State of Ohio, married taxpayers must make TWO SEPARATE $750 donations, one in each person’s name, to be eligible for the full $1,500 tax credit. A single donation made for $1,500 will be limited by the State of Ohio to a $750 tax credit.

- I withhold Ohio income tax throughout the year and usually owe nothing when I file my tax return. Would I be able to use an SGO tax credit? Yes! The SGO tax credit will reduce the TOTAL Ohio tax for the year, and for many taxpayers that withhold Ohio income tax throughout the year, it will result in a REFUND up to the amount of the tax credit. SGO can only offset up to the TOTAL Ohio tax amount for that year. (Ex. If the total Ohio tax liability is $975, a $1,500 total SGO will offset just $975). Most taxpayers with $100,000+ of income will have over $1,500 tax liability and be able to utilize the full SGO tax credit. We encourage you to consult with your tax advisor before making the gift.

- Questions for St. Mary School may be directed to Beth Mock / bmock@stmaryhp.org

2024 SGO Gifts can be made until April 15, 2025, or before you file your tax return, whichever comes first, to claim and include on your 2024 Tax Return.